TT Talk - The peaks and troughs of container utilisation

Container operators have enjoyed a buoyant period with high levels of equipment utilisation through the last couple of years. Increased demand has, of course, been accompanied by issues arising from congestion and supply chain bottlenecks, presenting challenges in repositioning empties to be packed.

Increased demand has resulted in numerous operational challenges. Apart from the established phenomenon of ‘street turns’1, by which units may only irregularly cycle through depots, high demand may have reduced the opportunity for routine and preventative maintenance. Furthermore, there may be reluctance on the part of shippers/packers to reject the presented unit on the basis of minor damage for fear of long waiting times for a replacement.

One way container operators have risen to the demand has been to build or lease more units. Now, it is being widely suggested that equilibrium has largely been restored, such that imbalances of equipment are less pronounced, reducing the strain on supply chains. Furthermore, peak e-commerce demands appear to have been reached and now may be in decline for the time-being (possibly related to broader economic and geopolitical narratives).

This leads some to predict that the combination of older equipment having been kept in service and new containers produced at record levels could now lead to a period, for the first time in a number of years, where the available container fleet outweighs demand for its use. What then?

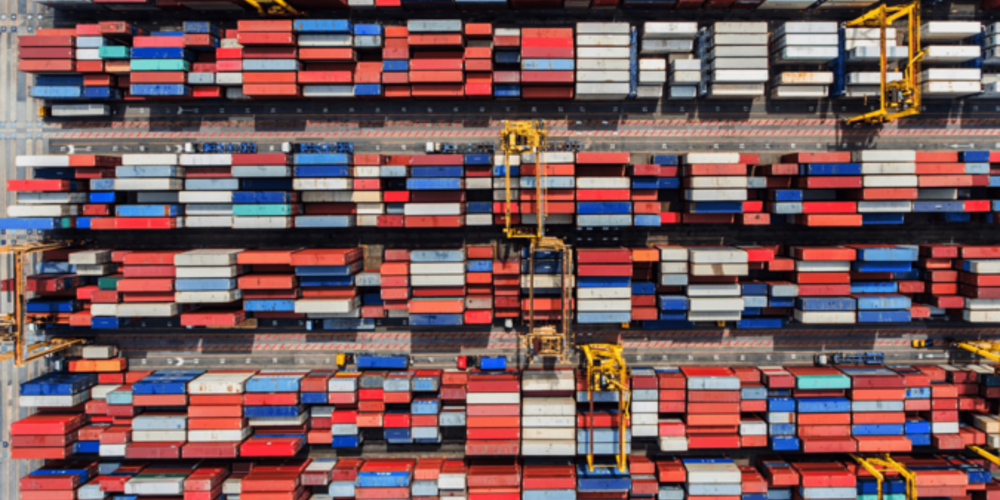

While it might be expected that any equipment kept in service beyond its natural economic life cycle through the pandemic period will now be retired, there may still be stock that remains stagnant for longer periods in depots, container yards or terminals.

Opportunity or risk?

A period of slowing demand would naturally provide opportunity to review service and maintenance regimes, not just in relation to regulatory requirements. A more pro-active approach to maintenance and repair may now be possible, perhaps even considering piloting emerging technologies, such as from ConexBird, to understand better the performance metrics of your container fleet and take more informed decisions.

A more pro-active approach to maintenance and repair may now be possible.

Equally, opportunities will emerge to reposition some equipment to take advantage of known or anticipated demand. This may require detailed assessment of where supply chains have changed, since historic demand of course could well be different post-pandemic.

Where demand remains low for an extended period, secondary container markets (often seeking to re-purpose for imaginative uses) will benefit from greater availability, potentially at more competitive rates.

Some operators may seek to upgrade existing units in the context of introducing ‘smart’ containers more extensively into their fleets, taking advantage of a range of ‘Internet of Things’ technologies to improve both safety and security. Any slowing trade demand may similarly provide opportunity to accelerate such initiatives.

Assuming that this can be well managed in a competitive marketplace, it could be argued that the global supply chain could accrue benefits from a reduced, but generally newer, fleet of containers at their disposal. Apart from possibly reducing cargo damage claims, fewer rejections and repositioning requirements, and a generally more efficient operation, may result in lower operational costs for all.

Conversely, in a world where supply subsequently exceeds demand, might idle equipment have gone unrepaired? While downtime presents opportunity in terms of time to undertake repairs, tight cost control would be inevitable. Should there be lower demand for equipment, it might be tempting to delay all but essential repairs. This in itself may not be problematic while the equipment is not in use. However, unpredictable peak demands are likely to continue to be experienced and it would be prudent to ensure that equipment is kept in sound operable condition.

While the pandemic challenges related to maintaining regulatory inspection regimes have dissipated, these are generally broad-brush and concerns have been raised as to how proactive government agencies have been. Where equipment is unlikely to be required for an extended period, it remains possible that lesser rigour will be applied relating to routine inspections and maintenance until demand returns.

A number of Beneficial Cargo Owners sought to circumvent supply chain disruptions during the last two years by purchasing their own containers (becoming ‘shipper owned containers’). As the market normalises, such trends may not remain economically viable. While giving greater flexibility during the disruptions of the last two years, it is likely that the direct and indirect efficiencies (including M&R and regulatory requirements) offered through the use of the carrier global fleet will return. There remains a risk that, in seeking cost containment, lower levels of maintenance might be undertaken in this shipper owned market.

A further concern arising from over-supply of units might be that depots, container yards and terminals become unmanageably congested with empty units. Through the pandemic and since then, the management of peaks and the imbalance of available equipment has been acute. In a market where demand falls, under-utilisation of the global fleet risks accentuating these same challenges. Empty container yard capacity may be exceeded, resulting in less controlled facilities and storage being in the wrong geographic areas in relation to shipper demand.

Concluding thought

The global supply chain has proved itself to be highly resilient in a variety of ways and there have been many learning points from experience through the COVID-19 pandemic. However, it would be prudent to ensure that operators consider these risks as the world transitions to demand that may less buoyant, less predictable and possibly more regional. Maintaining safe and sound units will make most operational sense in the long term.

Maintaining safe and sound units will make most operational sense in the long term.

-

If you would like further information, or have any comments, please email us, or take this opportunity to forward to any others who you may feel would be interested.

1 Where a unit is moved directly from the location it has been unpacked to the location the next shipment will be packed.

Documents

TT Talk 291 Chinese Translation (630 kB) 27/10/2022

- Author

- Peregrine Storrs-Fox

- Date

- 11/10/2022